COVID-19 will greatly reduce Africa’s GDP growth in 2020

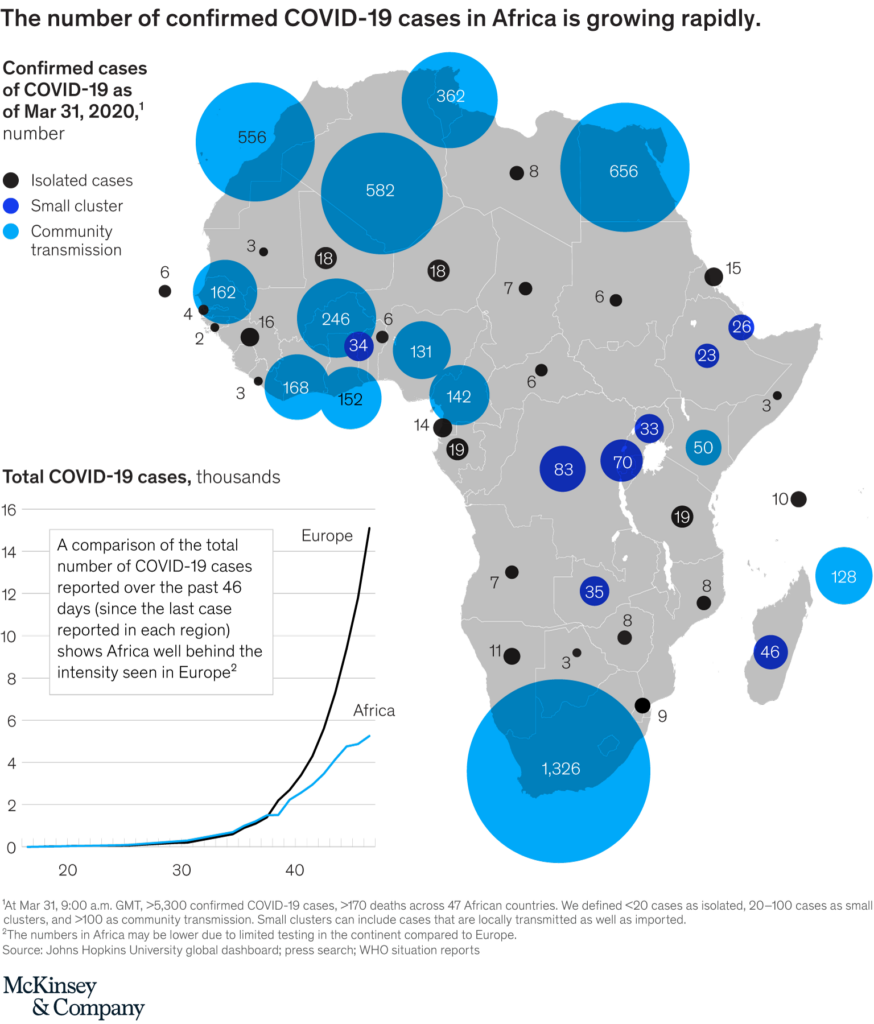

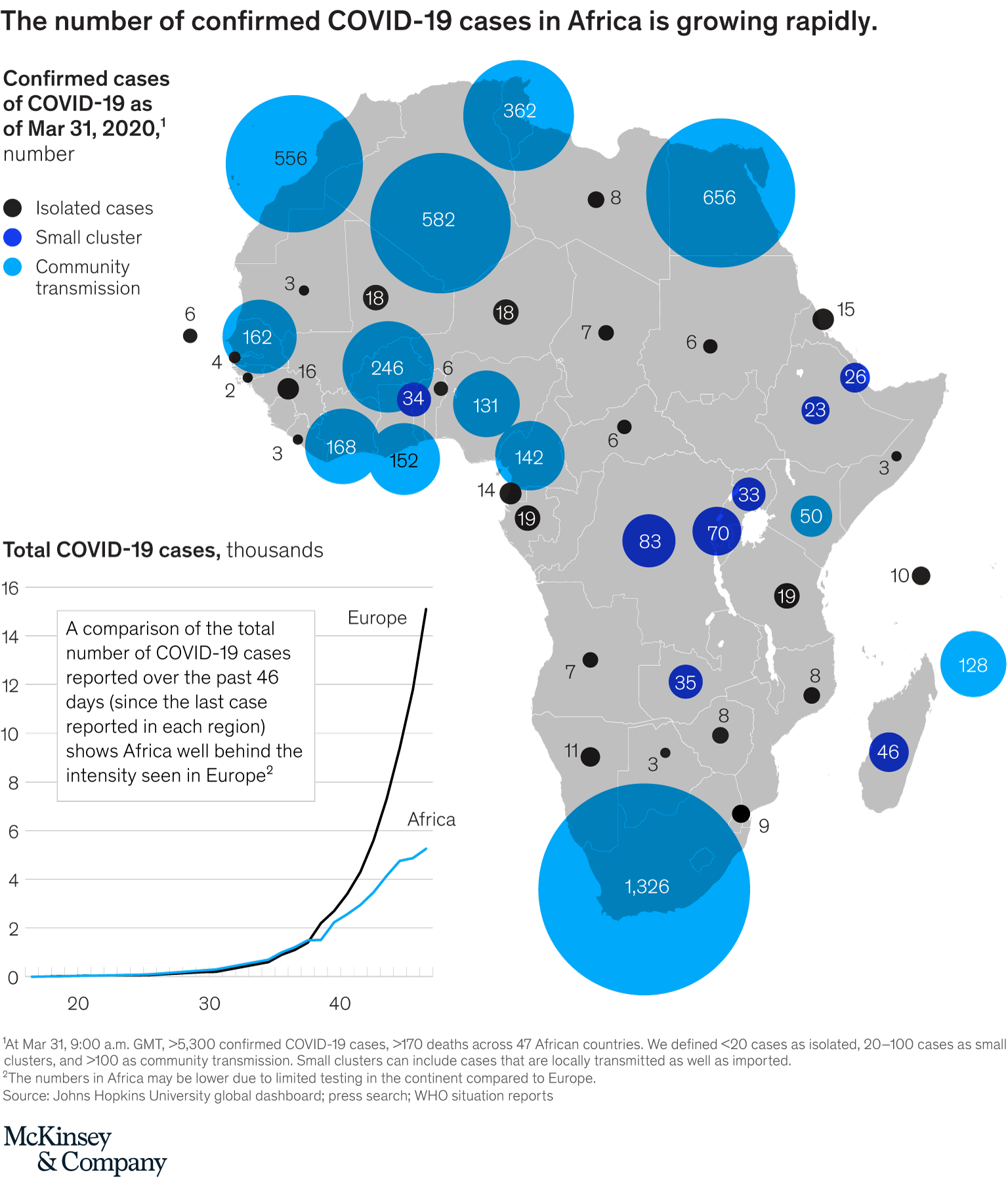

As of March 31, more than 720,000 cases of COVID-19 had been recorded worldwide, with nearly 40,000 deaths. The number of cases, and deaths, has been growing exponentially. Compared to other regions, the number of recorded cases in Africa is still relatively small, totaling about 5,300 cases across 47 African countries as of March 31 (Exhibit 1). Even though the rate of transmission in Africa to date appears to be slower than that in Europe, the pandemic could take a heavy toll across the continent if containment measures do not prove effective.

Against the backdrop of this worrying public-health situation, African countries will have to address three major economic challenges in the coming weeks and months:

- The impact of the global pandemic on African economies. This includes disruption in global supply chains exposed to inputs from Asia, Europe, and the Middle East, as well as lower demand in global markets for a wide range of African exports. Moreover, Africa is likely to experience delayed or reduced foreign direct investment (FDI) as partners from other continents redirect capital locally.

- The economic impact of the spread of the virus within Africa, and of the measures that governments are taking to stem the pandemic. Travel bans and lockdowns are not only limiting the movement of people across borders and within countries, but also disrupting ways of working for many individuals, businesses, and government agencies.

- The collapse of the oil price, driven by geopolitics as well as reduced demand in light of the pandemic. In the month of March 2020, oil prices fell by approximately 50 percent. For net oil-exporting countries, this will result in increased liquidity issues, lost tax revenues, and currency pressure. (We should note, however, that lower oil prices will potentially have a positive economic impact for oil-importing countries and consumers.)

For Africa’s economies, the implications of these challenges are far-reaching. A slowdown in overall economic growth is already being felt, and this is acute in hard-hit sectors such as tourism. Many businesses, particularly SMEs, are under significant cost pressure and face potential closure and bankruptcy. That is likely to lead to widespread job losses. At the same time, the pandemic will impact productivity across many sectors. Closures of schools and universities could create longer-term human capital issues for African economies—and could disproportionately affect girls, many of whom may not return to school. Not least, the crisis is likely to reduce household expenditure and consumption significantly.

The knock-on effects for the African public sector could be severe, in terms of reduced tax revenues and limitations on access to hard currency. African governments will face rising deficits and increased pressure on currencies. In the absence of significant fiscal stimulus packages, the combined impact of these economic, fiscal, and monetary challenges could greatly reduce Africa’s GDP growth in 2020.

Four scenarios of economic impact: Africa’s GDP growth reduced by three to eight percentage points

To gauge the possible extent of this impact, we modeled four scenarios for how differing rates of COVID-19 transmission—both globally and within Africa—would affect Africa’s economic growth. Even in the most optimistic scenario, we project that Africa’s GDP growth would be cut to just 0.4 percent in 2020—and this scenario is looking less and less likely by the day. In all other scenarios, we project that Africa will experience an economic contraction in 2020, with its GDP growth rate falling by between five and eight percentage points (Exhibits 2 and 3).

The four scenarios are as follows:

- Scenario 1: Contained global and Africa outbreak. In this least-worst case, Africa’s average GDP growth in 2020 would be cut from 3.9 percent (the forecast prior to the crisis) to 0.4 percent. This scenario assumes that Asia experiences a continued recovery from the pandemic, and a gradual economic restart. In Africa, we assume that most countries experience isolated cases or small cluster outbreaks—but with carefully managed restrictions and a strong response, there is no widespread outbreak.

- Scenario 2: Resurgent global outbreak, Africa contained. Under this scenario, Africa’s average GDP growth in 2020 would be cut by about five percentage points, resulting in a negative growth rate of −1.4 percent. Here we assume that Europe and the United States continue to face significant outbreaks, while Asian countries face a surge of re-infection as they attempt to restart economic activity. In Africa, we assume that most countries experience small cluster outbreaks that are carefully managed.

- Scenario 3: Contained global outbreak, Africa widespread. In this scenario, Africa’s average GDP growth in 2020 would be cut by about six percentage points, resulting in a negative growth rate of −2.1 percent. This assumes that significant outbreaks occur in most major African economies, leading to a substantial economic downturn. Globally, we assume that Asia experiences a continued recovery and a gradual economic restart, while large-scale quarantines and disruptions continue in Europe and the United States.

- Scenario 4: Resurgent global outbreak, Africa widespread. In this case, Africa’s average GDP growth in 2020 would be cut by about eight percentage points, resulting in a negative growth rate of −3.9 percent. Globally, we assume that Europe and the United States continue to face significant outbreaks as China and East Asian countries face a surge of re-infection. In addition, significant outbreaks occur in most major African economies, leading to a serious economic downturn.

These scenarios do not take into account the potential effects of any fiscal stimulus packages that may be announced by African governments; these should improve the economic outlook. However, we should also note that the scenarios do not take into account currency devaluations, inflationary pressure, or recent credit ratings from Moody’s and similar bodies—which could worsen the outlook. There is no room for complacency. (For a full explanation of the methodology underlying our analysis, see the note at the end of this paper.)

Depending on the scenario, Africa’s economies could experience a loss of between $90 billion and $200 billion in 2020. Each of the three economic challenges outlined above is likely to cause large-scale disruption. The pandemic’s spread within Africa could account for just over half of this loss, driven by reduced household and business spending and travel bans. The global pandemic could account for about one-third of the total loss, driven by supply-chain disruptions, a fall-off in demand for Africa’s non-oil exports, and delay or cancellation of investments from Africa’s FDI partners. Finally, oil-price effects could account for about 15 percent of the losses.

Differing impact on major African economies

While the pandemic’s economic impact—alongside the oil-price shock—will be serious right across the continent, it will be felt differently in different countries. For example, our analysis suggests that the following impacts would occur in Nigeria, South Africa, and Kenya:

- Nigeria. Across all scenarios, Nigeria is facing a likely economic contraction. In the least worst-case scenario (contained outbreak), Nigeria’s GDP growth could decline from 2.5 percent to −3.4 percent in 2020—in other words, a decline of nearly six percentage points. That would represent a reduction in GDP of approximately $20 billion, with more than two-thirds of the direct impact coming from oil-price effects, given Nigeria’s status as a major oil exporter. In scenarios in which the outbreak is not contained, Nigeria’s GDP growth rate could fall to −8.8 percent, representing a reduction in GDP of some $40 billion. The biggest driver of this loss would be a reduction in consumer spending in food and beverages, clothing, and transport.

- South Africa. Across all scenarios, South Africa is facing a likely economic contraction. Under the contained-outbreak scenario, GDP growth could decline from 0.8 percent to −2.1 percent. This would represent a reduction in GDP of some $10 billion, with about 40 percent of that stemming from supply-chain import disruptions, which will impact manufacturing, metals and mining in particular. There will also be major impact on tourism and consumption. However, as South Africa is an oil importer, this impact will be cushioned by lower oil prices. In scenarios in which the outbreak is not contained, South Africa’s GDP growth could fall to −8.3 percent, representing a loss to GDP of some $35 billion. This impact would be driven by disruptions in household and business spending on transport, food and beverages, and entertainment, as well as prolonged pressure on exports. South Africa’s recent sovereign-credit downgrade is likely to exacerbate this outlook.

- Kenya. In two out of four scenarios, Kenya is facing a likely economic contraction. Under the contained-outbreak scenario, GDP growth could decline from 5.2 percent (after accounting for the 2020 locust invasion) to 1.9 percent—representing a reduction in GDP of $3 billion. The biggest impacts in terms of loss to GDP are reductions in household and business spending (about 50 percent), disruption to supply chain for key inputs in machinery and chemicals (about 30 percent), and tourism (about 20 percent). In scenarios in which the outbreak is not contained, Kenya’s GDP growth rate could fall to −5 percent, representing a loss to GDP of $10 billion. As in Nigeria, disruption of consumer spend would be the biggest driver of this loss.

PART 3: Bold Action Needed Now

Click to Read Part 1: Tackling COVID-19 in Africa